All About Letter Of Credit (LC)

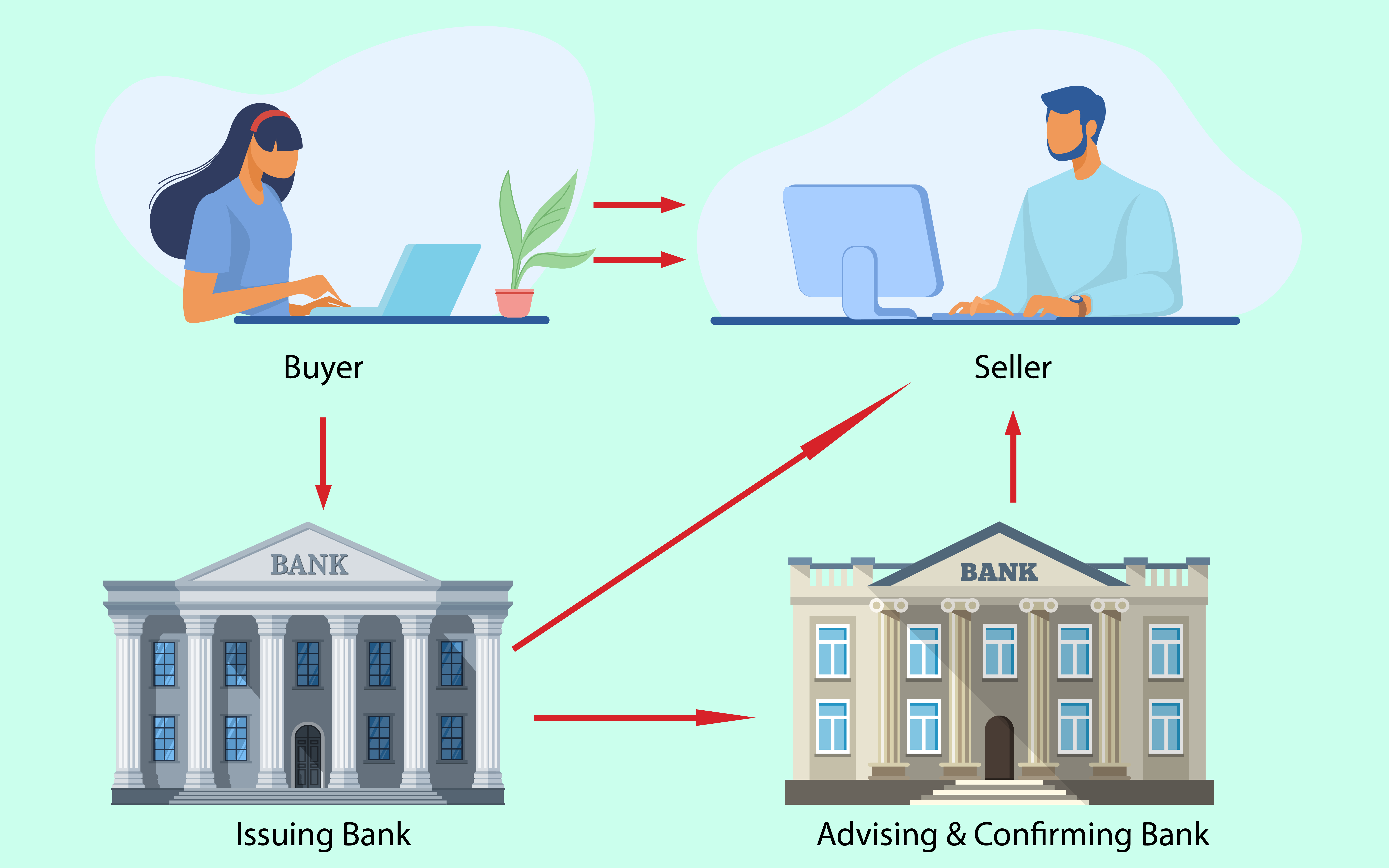

A Letter of Credit (LC), also known as a documentary credit, is a financial instrument commonly used in international trade to facilitate secure and reliable payment transactions between a buyer (importer) and a seller (exporter). It provides a guarantee from a bank that the seller will receive payment for the goods or services they deliver if they meet the conditions specified in the LC.

There are several types of Letters of Credit, each tailored to specific requirements and circumstances in international trade. Here are some of the different types of LCs:

-

Commercial Letter of Credit:

- This is the most common type of LC used in international trade. It ensures that the seller will receive payment as long as they fulfill the terms and conditions outlined in the LC, which typically include presenting the required documents (e.g., invoice, bill of lading) and complying with agreed-upon shipping or delivery terms.

-

Revocable Letter of Credit:

- A revocable LC can be modified or canceled by the buyer without prior notice to the seller. It provides less security for the seller because the terms can be changed after the goods have been shipped.

-

Irrevocable Letter of Credit:

- An irrevocable LC cannot be changed or canceled without the consent of all parties involved (buyer, seller, and issuing bank). It provides a higher level of security for the seller.

-

Confirmed Letter of Credit:

- A confirmed LC involves two banks: the issuing bank and a confirming bank. The confirming bank adds its guarantee to the LC, assuring the seller of payment even if the issuing bank defaults. This type of LC is often used when the seller is uncertain about the financial stability of the buyer's bank.

-

Transferable Letter of Credit:

- A transferable LC allows the seller (first beneficiary) to transfer a portion of the LC to one or more secondary beneficiaries, typically when the seller is acting as a middleman in a transaction. This is useful when the seller needs to involve subcontractors or suppliers to fulfill the order.

-

Standby Letter of Credit (SBLC):

- Unlike a commercial LC, an SBLC is not meant for the actual purchase of goods or services. Instead, it serves as a financial guarantee to ensure that the buyer will meet their financial obligations to the seller. SBLCs are often used in non-trade transactions, such as construction projects and lease agreements.

-

Red Clause Letter of Credit:

- A red clause LC includes a special clause (usually printed in red ink) that allows the seller to receive an advance payment before the shipment of goods. This type of LC is less common today but was historically used to provide working capital to exporters.

-

Green Clause Letter of Credit:

- A green clause LC is similar to a red clause LC but includes an additional clause allowing the seller to store the goods in a warehouse and make partial shipments over time. It is rarely used in modern international trade.

-

Revolving Letter of Credit:

- A revolving LC can be used for multiple shipments over a specified period. Once a shipment is paid for, the LC "revolves" to its original amount, making it available for future shipments without the need to issue a new LC.

-

Back-to-Back Letter of Credit:

- In a back-to-back LC arrangement, a seller receives an LC from a buyer and then uses it as collateral to secure a new LC for purchasing goods or services from a third party. This is often used in triangular trade or when intermediaries are involved.

The choice of the type of Letter of Credit depends on the specific requirements and preferences of the parties involved in the international trade transaction. It's essential for buyers and sellers to carefully review and negotiate the terms and conditions of the LC to ensure that they align with their respective needs and obligations.